After our successful IPO, five of our experts answered numerous questions from the Community. Viewers voted beforehand as to which topics they didn’t want missed. For those that didn’t have the chance to follow the presentation in real-time or do not understand German, we’ve briefly summarized the most important insights for you.

You can find the entire livestream here (in German only) which, in addition to extensive Q&A sessions, also includes interesting presentations from Torsten (finance), Mathieu (solar), Thomas (Sion), Friedrich (HR) and of course Laurin and Jona.

1. According to media reports, the head of contract manufacturer NEVS recently said, “we have no production agreements with Sono Motors. They first have to go public and raise money.” Where do we go from here?

An update regarding our Production Partner is available since the 5th April, 2022. Find all information here.

2. Can you present the data that shows the charging performance achieved over a long period in practice? For example a curve that illustrates charging performance in different weather conditions over a day?

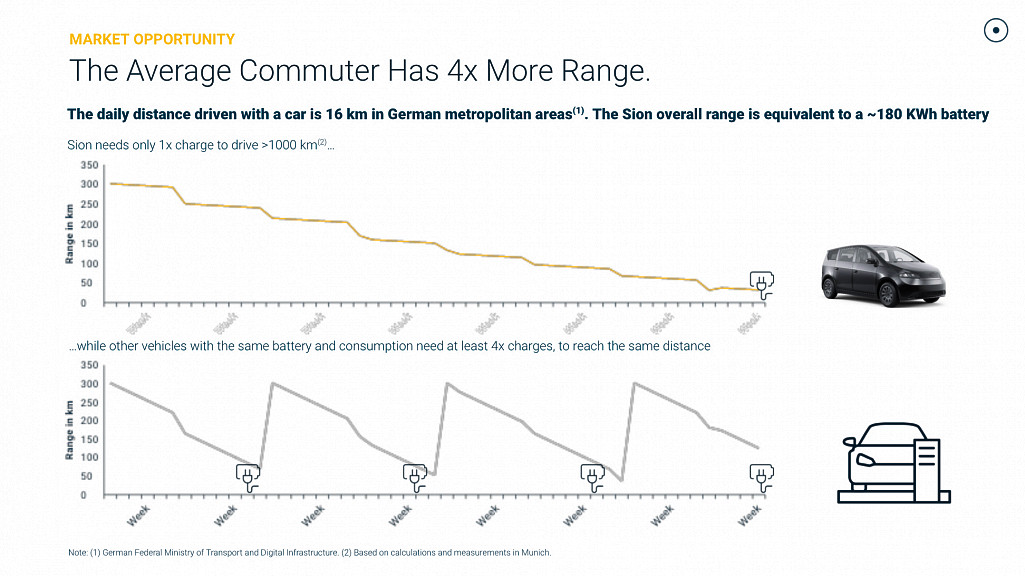

The Sion can generate additional range from the power of the sun alone, averaging 112 km per week (max. 245 km in a week of sunny weather). Sion users can almost completely self-sufficiently cover an average work commute and have to charge the car up to four times less often than a conventional electric car. We have created this graphic to illustrate this:

You also can find more information regarding solar integration in other types of vehicles by following this link. These use cases are based on calculations using weather data from our home-base in Munich. As soon as we have more detailed test results, we will of course publish them.

3. Is it true that in addition to the 156 million US dollars now raised, further funding will be needed up to the start of production?

The IPO enabled us to raise total net proceeds of 157 million US dollars (137 million euros). We are using these funds primarily to finance the development of series-validation vehicles. According to current planning, we need more than 350 million euros until the start of series production. It is therefore correct that we need to raise at least another 200 million euros.

As a listed company, we will now have a greater degree of flexibility to raise further capital on the stock market. There are also a few financing options in addition to this, such as loans or convertible bonds.

4. What has actually become of the Sono Points? How does the IPO affect these?

Going public changes basically nothing in terms of the Sono Points. The Points are so-called profit participation rights for Laurin, Jona and Navina’s shares. They continue to hold these shares and thereby want to set an example of how to practice entrepreneurship.

Now that we are publicly listed on NASDAQ after the successful IPO, it becomes much easier for the founders to sell a certain number of shares. The profit from this can also be paid out proportionally, after deduction of taxes and costs, to reservation holders with existing Points. For those who would like to learn more about Sono Points, you can find all the important information on our website in the ‘Profit Sharing’ section of our FAQs.

5. Would you really have gone into insolvency in December or did you have a plan B?

As can be read in our prospectus for the SEC, we are, like many young companies, dependent on further financing. It is true, however, that we were very confident in the IPO. The IPO is another milestone on the way to delivering the Sion to our Community and furthering our mission.

6. Have the 10 million convertible loans from the 2020 crowdfunding campaign arrived by now? If not, why?

We received 53 million euros in payment commitments from the 2020 crowdfunding campaign. Of this, 37 million euros have been retrieved. The 10 million euros would have been a convertible loan. This convertible loan has not been retrieved, as we received better conditions through the IPO.

7. Why was no subscription offer made to those with pre-orders prior to the IPO?

The decision to go public in the USA meant that we could not advertise our IPO in Germany. We were only allowed to admit investors who invest under SEC regulations.

For Germany, for example, we would have had to prepare a BaFin prospectus, which was not possible under the circumstances. We decided to go public on NASDAQ, that is to say in the USA, as it is the best thing for the company and therefore also for reservation holders and all other supporters.

Sono Motors’ shares are now tradeable on NASDAQ. Some brokers and banks allow these shares to be traded in Germany. We can be found principally under the SEV ticker symbol, WKN:A3C7QW, in Germany.

8. How can investors who have acquired shares via Seedrs have them transferred to their share deposit account?

After the IPO, your shares will continue to be held by Seedrs through their broker, currently Cannaccord. All investors who wish to sell their shares, must notify Seedrs. Seedrs will provide further information as soon as the shares are listed and investors can sell the shares. To our knowledge, the existing Sono shares are converted with a factor of 1.71. This should soon be displayed in your individual Seedrs accounts. As is usual with IPOs, there is a 180 day vesting period, i.e you cannot sell your shares within the first 180 days after the IPO.